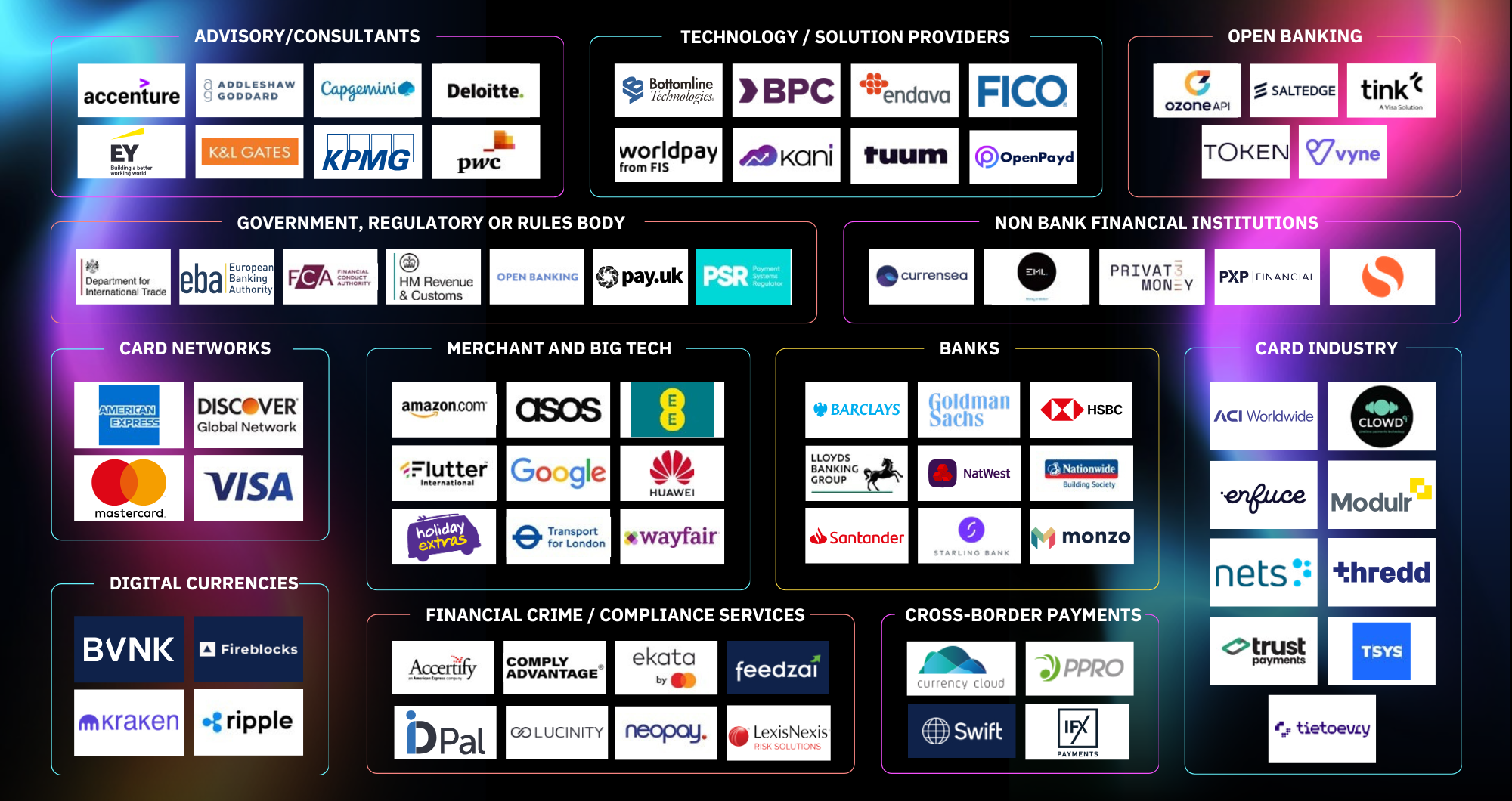

PAY360 is bringing together the entire ecosystem under one roof—from policy makers, regulators, banks, and merchants to big tech, card networks, acquirers, and processors. With a laser focus 100% on payments, the event is designed by the community, for the community, ensuring that every session, speaker, and networking opportunity is crafted to inform, inspire, and drive the industry forward. As an inclusive event accessible to businesses of all sizes, PAY360 offers free exhibition passes, making it possible for everyone to benefit from the latest insights and opportunities. With 6,000 payments professionals, 200+ expert speakers, 150 exhibitors, and an audience where over half are VP-level or above, PAY360 is the place where connections are forged, ideas are shared, and the future of payments is shaped.

If you’re serious about shaping the future of payments, attending PAY360 as a delegate offers unmatched access, insight and opportunity. Here’s what sets the delegate experience apart:.

Unlike visitor passes, your delegate ticket gives you full access to all conference sessions, the exhibition floor, and every networking feature. That means more conversations, deeper insights, and real opportunities to drive your business forward.

1,700+ professionals attend as delegates, and nearly 60% are VP-level and above. This is your chance to connect with senior leaders from across the payments value chain – including banks, fintechs, merchants, PSPs, acquirers, and regulators.

With over 40 C-suite keynotes and more than 200 hand-picked speakers, the PAY360 agenda is second to none. We don’t do call-for-papers – we curate every speaker to ensure the sharpest insights and most relevant conversations. Built through the insights of our payments community for the community.

Delegates get exclusive access to premium features on the PAY360 app, including AI matchmaking, lead scanning and full attendee messaging. You’ll also enjoy access to meeting zones, the delegate village, and PAY360 After Hours networking – all designed to help you make meaningful connections.

Your delegate pass includes our Tap & Taste wearables, giving you the freedom to enjoy food and drink across the venue whenever it suits you. No queues, no tokens – just seamless hospitality so you can focus on what matters.

Explore emerging forms of digital money, including cryptocurrencies, stablecoins, digital wallets, and central bank digital currencies (CBDCs).

Understand how these innovations are reshaping global payments, financial infrastructure and monetary systems.

Understand how institutions are embedding resilience into their digital transformation strategies to withstand operational disruption.

Explore frameworks, technologies and regulatory expectations for ensuring sustainability, security and agility.

Discover how artificial intelligence and data-driven strategies are transforming financial services, from risk modelling to customer experience.

Explore ethical considerations, model governance, and regulatory expectations surrounding AI adoption

Examine how open banking and open finance are enabling seamless, secure, and user-permissioned access to financial data and services.

Discover the technologies and standards driving innovation in payments, from APIs to embedded finance and real-time data sharing.

Discover how firms are leveraging technology to enhance AML, fraud detection, and compliance effectiveness.

Examine global regulatory developments and cross-sector collaboration to combat evolving financial crime risks.

Dive into the infrastructure, use cases, and innovations powering instant payment ecosystems across regions.

Examine how real-time payments are reshaping customer expectations, liquidity management, and cross-border transactions.